Marcus Licinius Crassus, Robert Morris, and John Pierpont Morgan were rich in dollar terms.

Yes, all three were extremely wealthy, but understanding their true wealth requires careful consideration of context and inflation! Let’s break it down:

Challenges of Direct Comparison

- Inflation: Comparing wealth directly using modern dollar values can be misleading. The value of currency vastly changes over time due to inflation. A million dollars in Ancient Rome had a very different purchasing power than today’s.

- Economic Systems: The nature of wealth has changed throughout history. Crassus’ holdings were primarily in land and property, whereas Morgan’s wealth was heavily tied to stocks and investments—these assets have vastly different dynamics.

- Incomplete Records: Accurate assessments of a figure’s total wealth are difficult due to incomplete historical records, especially for figures like Crassus.

Estimating Their Wealth

To get a better understanding, we can use these approaches:

- Relative to Contemporaries: All three men were easily among the richest individuals of their time. This means their power to purchase goods and services and influence were exceptionally outsized compared to the average person.

- Estimated Net Worths (Adjusted): Here are some VERY ROUGH estimations attempting to adjust for inflation, but take these with a grain of salt:

- Crassus: Possibly equivalent to billions in modern US dollars.

- Morris: Likely worth hundreds of millions in today’s dollars.

- Morgan: Net worth estimated at tens of billions in modern US dollars.

Key Points:

- Focus on Influence: How they used their wealth is more important than the exact dollar figure. Due to their financial resources, they shaped economies, funded wars, and influenced the lives of countless people.

- Immense Power: Even with rough estimations, it’s clear these men wielded immense fortunes, giving them exceptional power in their times.

Is there a specific period you’re interested in regarding inflation calculations? Or, would you like to discuss how their wealth translated into power within their different societies?

Marcus Licinius Crassus History

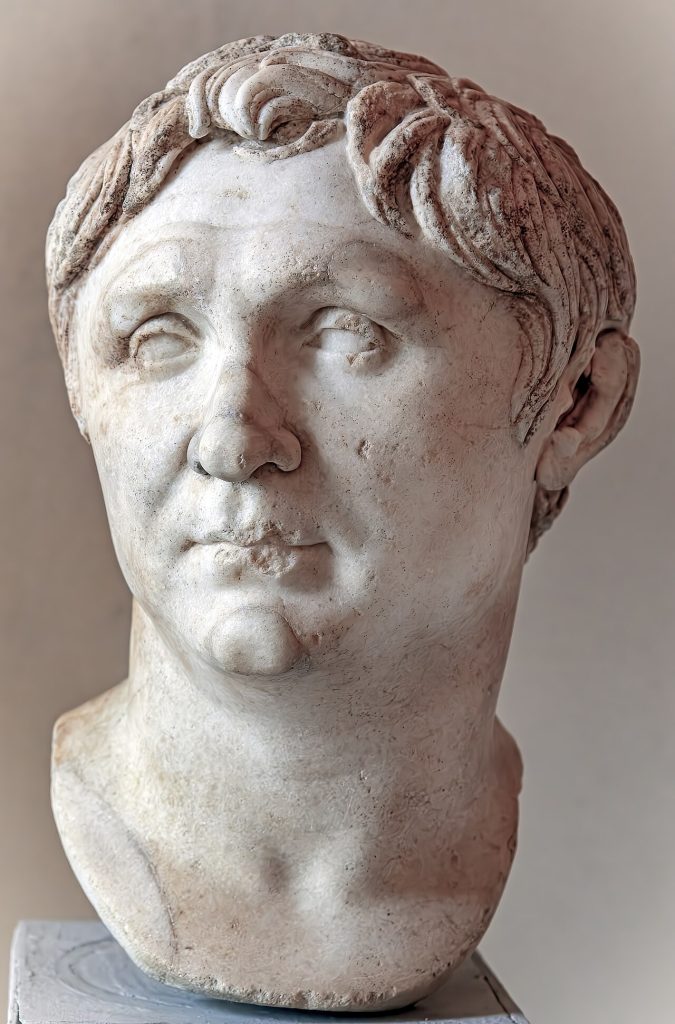

Bust was found in the Licinian Tombs in Rome and was traditionally identified as Crassus (Wiki Image).

Unfortunately, finding ten well-documented, verified quotes directly from Marcus Licinius Crassus is incredibly difficult. Ancient Romans weren’t known for recording the witty pronouncements of their politicians and statesmen in the same way we do today.

However, there’s a mix of what we can put together:

Quotes from Historical Sources

- “Why have you left us for Gracchus and the mob?” – This quote is from the movie “Spartacus” where Crassus confronts Caesar, but there’s no historical record of him saying it.

- “No! Rome is an eternal thought in the mind of God.” – Likewise, from the film “Spartacus,” this line offers dramatic insight into the character but is not historically attributed to Crassus.

Quotes Possible Based on His Actions

These quotes are not historically attributed to Crassus, but they reflect his known character traits and actions:

- “A man’s wealth is measured by the properties he owns.” – Reflects his ruthless property speculation.

- “The only true power is measured in gold.” – Reflects his belief in the importance of material wealth.

- “Every man has a price, you just need to find it.” – Reflects the manipulative tactics he employed.

- “Compassion is a weakness for lesser men.” – Likely echoes his ruthless nature as displayed in the suppression of the Spartacus Revolt.

- “The ends always justify the means.” – A Machiavellian principle that suits his methods of acquiring wealth and power.

Quotes Inspired by His Legacy

- “Greed is a bottomless pit.” – This could be an observation about Crassus, not something from him.

- “Those who live by gold, may die by it.” – References a possible way his death is interpreted.

- “Ambition without scruples is a dangerous path.” – A possible warning inspired by his fate.

- “Great fortunes can breed great enemies.” – Reflects an outcome of his vast wealth.

- “Legacy is what you leave behind, not what you take with you.” – Crassus left behind immense wealth but a tarnished reputation – this might provoke thought.

Important Note: It is crucial to understand that most “quotes” associated with figures from ancient history are either dramatized, misattributed, or even completely invented for artistic purposes.

| Year (approx.) | Age (approx.) | Events & Developments | Financial Activities |

|---|---|---|---|

| 115 BC | 0 | Born into a wealthy Roman family. | – Inherits a significant fortune from his family. |

| 80s BC | 20s | – Sulla’s Civil War: Sides with Sulla against Marius and Cinna. <br> – Proscriptions: Takes advantage of the proscriptions (confiscation of property and execution of enemies of the state) to acquire property at low prices. | – Begins to build his wealth through shrewd real estate deals and political connections. <br> – Develops a reputation for ruthlessness in acquiring wealth. |

| 70s BC | 30s | – Third Servile War (Spartacus’s revolt): Raises and commands legions at his own expense to suppress the slave revolt. <br> – Elected Consul (70 BC) with Pompey the Great. | – Further increases his wealth by confiscating the property of rebellious slaves. <br> – Uses his wealth to gain political influence and military command. |

| 60s BC | 40s-50s | – First Triumvirate: Forms an unofficial political alliance with Julius Caesar and Pompey the Great. <br> – Invests in various ventures, including public works projects and tax farming. | – Uses his political influence to secure lucrative contracts and business deals. <br> – Becomes a major financier and political patron of Caesar. |

| 55 BC | 60 | – Elected Consul for a second time with Pompey. <br> – Given governorship of Syria. | – Seeks to expand his wealth and influence through military conquest in the East. |

| 54-53 BC | 61-62 | – Parthian War: Leads a disastrous campaign against the Parthians. | – Suffers heavy financial losses due to the failed campaign. |

| 53 BC | 62 | – Killed at the Battle of Carrhae. | – His death marks the end of the First Triumvirate and contributes to the rise of Caesar. |

How did Crassus Become so Wealthy?

(YouTube video)

Here’s a deeper dive into the life and history of Marcus Licinius Crassus, focusing on key aspects:

Early Life and Family

- Born around 115 BC into the prominent Roman Licinian gens, a plebeian family.

- His father, Publius Licinius Crassus, was an accomplished statesman and military leader.

- In 87 BC, Crassus fled Rome to escape the Marian persecutions. He found refuge in Spain.

Rise to Power

- Gained military experience under Sulla during the civil war in the 80s BC, becoming one of Sulla’s trusted commanders.

- Leveraged his military success and Sulla’s patronage to amass a fortune through ruthless means during prescriptions (confiscation and sale of enemies’ properties).

- He built a vast network of clients and debtors, extending his influence.

Political Successes

- Suppression of the Spartacus Slave Revolt (73-71 BC): This demonstrated his military prowess and ruthlessness, increasing his prestige, though he shared some credit with Pompey the Great.

- First Consulship (70 BC): Shared consulship with his rival Pompey, with whom he had a tense but functional relationship. They undid some of Sulla’s more restrictive constitutional reforms.

- The First Triumvirate: Formed a powerful political alliance with Caesar and Pompey around 60 BC, dominating Roman politics for several years.

Amassing Enormous Wealth

- Real Estate Speculation: Bought properties damaged in fires or civil unrest at low prices, used slave labor for repairs, and resold them for profit.

- Ownership of Silver Mines: Provided a source of steady income.

- Moneylending: Granted loans at high interest rates, increasing his wealth through control of debt.

- Firefighting: Some sources indicate he owned private fire brigades, allegedly creating fires or refusing to act before negotiating with property owners for a profit.

Downfall and Death

- Military Ambition: Desired the military glory of rivals like Pompey.

- Parthian Campaign (55-53 BC): He led a disastrous campaign against Parthia (modern-day Iran). His legions were massacred at the Battle of Carrhae, and he was killed, allegedly having molten gold poured down his throat as a mockery of his greed.

Legacy

- Remembered as one of the richest men in Roman history, a symbol of greed and ambition.

- Played a significant role in the transformation of the Roman Republic, his wealth and influence eventually contributing to its collapse.

Let me know if you’d like more detail on a particular aspect of Crassus’s life.

Crassus was born around 115 BC into the prominent Roman Licinian gens, a plebeian family. His father, Publius Licinius Crassus, was an accomplished statesman and military leader. In 87 BC, Crassus fled Rome to escape the Marian persecutions. He found refuge in Spain.

1st century BC marble bust, the so-called “Marius” (Wiki Image).

Absolutely! Here’s a breakdown of that information about Marcus Licinius Crassus, focusing on the important historical context:

- Family Background:

- Licinian Gens: This was an ancient and respected family in Rome, holding several consulships (the highest political office). However, it’s important to note they weren’t the wealthiest or most powerful of the patrician (aristocratic) clans.

- Plebeian: Although an old family, they belonged to the plebs, the common people of Rome, as opposed to the elite patricians. This social status carried limitations on political opportunities and privileges in early Rome.

- His Father: Publius Licinius Crassus

- Statesman: Had a distinguished political career, including attaining the position of consul in 95 BC.

- Military Leader: In 93 BC, he gained a triumph (a major military honor) for victories in Lusitania (modern-day Portugal). This shows significant influence and skill, which impacted Marcus’s upbringing.

- Civil War & Exile (87 BC):

- Marian Persecutions: This refers to a bloody period during the civil war between Marius and Sulla. Crassus’s father and brother were killed by the Marians, forcing him to flee for his life.

- Spain: He found safety in Hispania (modern-day Spain), likely due to his family’s connections from his father’s regional military campaigns.

Why does this matter?

- Provides Context: It shows his family was politically connected but not at the highest level of Roman society.

- Exile: The early experience of loss and danger likely shaped his ambition and ruthlessness later in life.

- Foundation for Future: His father’s connections and his survival of the Marian purge contributed to the early opportunities Crassus could leverage in Sulla’s faction.

Let me know if you’d like more information on any specific part of this background!

Crassus gained military experience under Sulla during the civil war in the 80s BC, becoming one of Sulla’s trusted commanders.

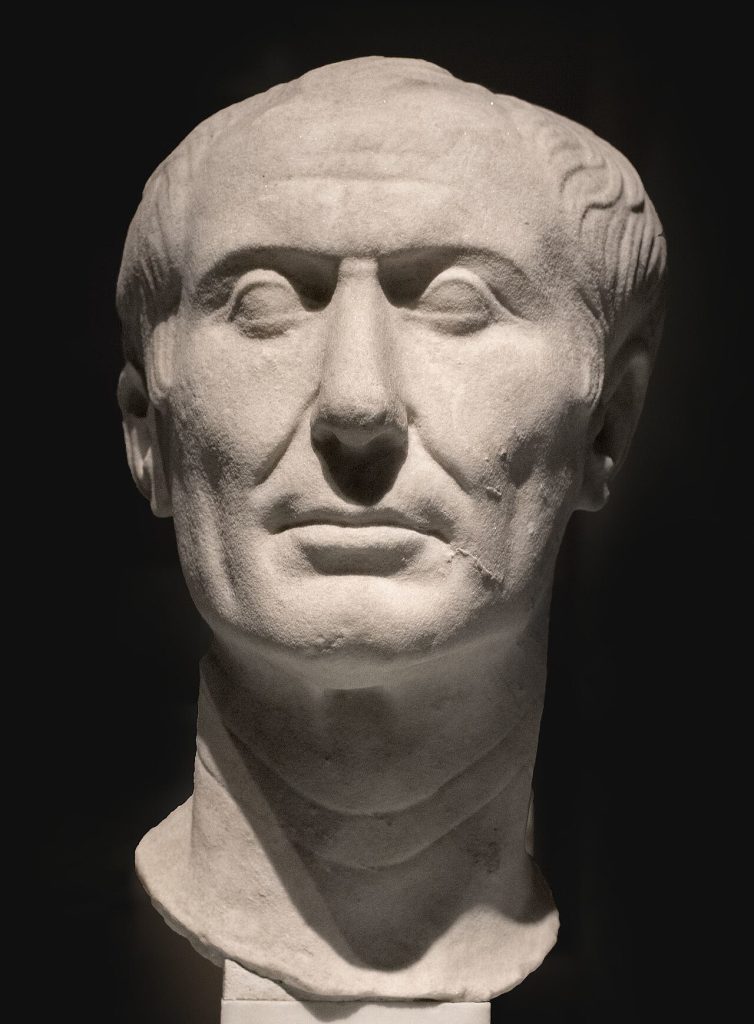

Possible portrait bust of Lucius Cornelius Sulla, Marius’s former legate and the general he would fight with for control of the Mithridatic War (Wiki Image).

Right! Crassus’s experience under Sulla was a pivotal turning point in his life. Here’s a deeper dive into this period:

The 80s BC Civil War:

- This was a brutal power struggle between two prominent Roman generals, Gaius Marius and Lucius Cornelius Sulla.

- Having fled the Marian persecutions, Crassus chose to side with Sulla, seeking revenge and political advancement.

Sulla’s Trusted Commander:

- Crassus’s political background and family connections likely helped him gain some initial standing with Sulla.

- However, Crassus proved himself a capable military leader. His victories at Spoletium and the siege of Carrinae established his reputation.

- Notably, Crassus commanded the right flank at the decisive Battle of the Colline Gate, showcasing Sulla’s trust in his abilities.

Benefits for Crassus:

- This period provided Crassus with several advantages:

- Military Glory: Victories under Sulla enhanced his standing and public image.

- Political Patronage: Sulla’s backing opened doors to higher political office later.

- Wealth Accumulation: Wealth could be acquired through spoils of war and land confiscations (the confiscation of the proscribed properties of Sulla’s enemies).

Crassus’s Ruthlessness Emerges:

- Some sources suggest Crassus may have employed brutal tactics during this time, further demonstrating his ambition and lack of moral qualms, traits that would mark his career.

Overall Significance:

- This period of military service was a launchpad for Crassus’s future political and financial success. It also solidified his reputation as a ruthless and cunning individual.

Is there anything specific you’d like to know about Crassus’s role in the civil war or his relationship with Sulla?

Crassus leveraged his military success and Sulla’s patronage to amass a fortune through ruthless means during prescriptions (confiscation and sale of enemies’ properties).

Absolutely! Here’s how Crassus exploited proscriptions and his connection to Sulla to accumulate his enormous wealth:

What were the proscriptions?

- Proscription lists: During Sulla’s dictatorship, lists of “enemies of the state” were publicly posted. Anyone on these lists could be killed with impunity and their property seized by the state.

- Political Abuse: While intended to target Sulla’s opponents, proscriptions became a tool for personal revenge, extortion, and simple greed.

How Crassus exploited the system:

- Buying Low: Crassus used his political influence and inside knowledge to buy up confiscated properties at meager prices, often before they officially hit the market.

- Threats & Intimidation: He likely used his position as a commander to intimidate owners into selling or acquiring properties for less than their true worth.

- Targeting the Wealthy: Crassus specifically focused on acquiring the valuable estates and properties of affluent Romans who had fallen out of favor with Sulla.

- Speculative Wealth: He’d renovate these properties using his slave labor or hold them for later resale when the market stabilized.

Ruthlessness in action:

- Sources suggest Crassus included individuals on lists for purely financial gain, not just political reasons.

- He acquired such vast amounts of property that he became known as “Dives,” which means “the rich.”

- This opportunism contributed to his reputation as someone willing to exploit the misfortune of others for personal wealth.

The legacy of Sulla’s patronage:

- Crassus would never have amassed such a fortune without his close association with Sulla. Sulla’s power enabled the prosections, and Crassus benefited directly.

Let me know if you’d like more historical context on how proscriptions worked in Rome and why they were so controversial!

Crassus built a vast network of clients and debtors, extending his influence.

You’re completely right! Crassus’s network of clients and debtors was central to his power and influence in Roman society. Here’s how it worked:

Patronage System in Ancient Rome:

- Cliens (Client): In Rome, people of lower social status would attach themselves to wealthy patrons for protection, legal aid, and financial support.

- Patronus (Patron): Powerful individuals would provide those benefits in exchange for loyalty, political support, and various services.

Crassus’s Use of Patronage:

- Clients: Crassus actively cultivated many clients, including freedmen, plebeians (common citizens), and even members of higher social classes.

- Debt as Control: He’d offer loans, often at favorable rates, but used debt to bind people to him. Those in debt owed him political favors, votes, and even personal services.

- Legal Support: Crassus could use his legal knowledge (and threats) to help clients settle disputes or navigate the Roman legal system, further fostering dependence.

How this extended His Influence:

- Political Power: His web of clients provided a reliable voting bloc in elections, helping him maintain political office and influence policy.

- Financial Control: Many debtors relied on Crassus’s goodwill to refinance loans or avoid harsh consequences, further expanding his economic power.

- Social Control: His network enabled Crassus to spread rumors, sway public opinion, and even orchestrate political demonstrations when needed.

The Dark Side:

- It’s important to remember that this system was often exploitative. Clients might be forced to support Crassus’s ambitions even when they were against their interests.

- The power imbalance inherent in this system added to Crassus’s ruthlessness and contributed to societal divisions in Rome.

Would you like to know more about the Roman Patron-Client system or specific examples of how Crassus used his vast network?

Crassus suppression of the Spartacus Slave Revolt (73-71 BC) demonstrated his military prowess and ruthlessness, increasing his prestige, though he shared some credit with Pompey the Great.

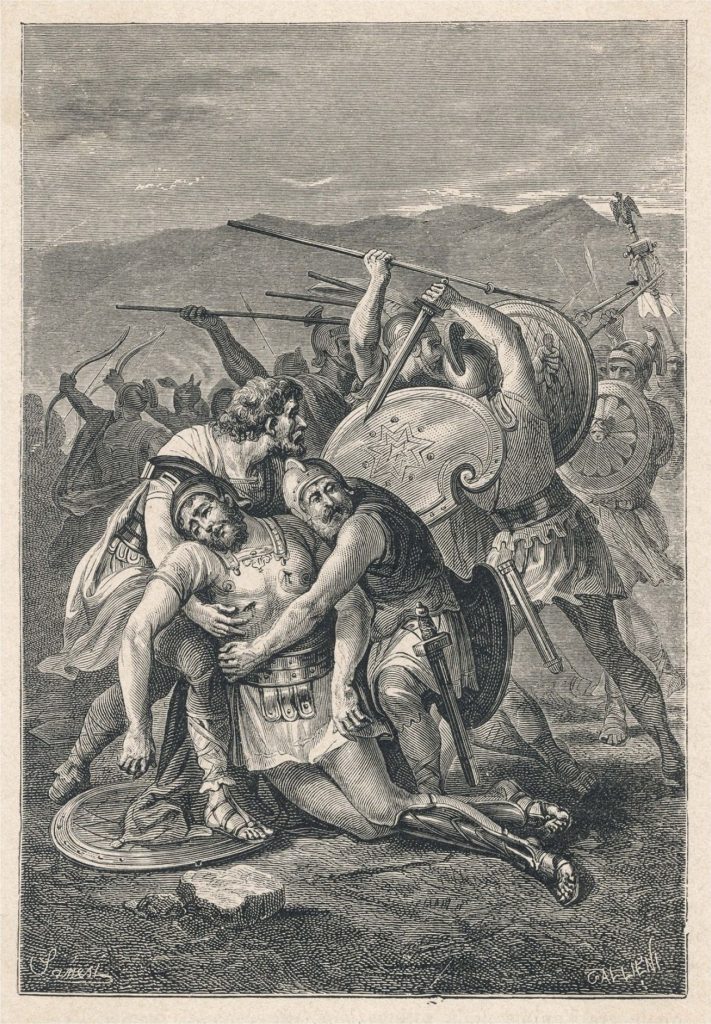

A 19th-century depiction of the fall of Spartacus by the Italian Nicola Sanesi (1818–1889) (Wiki Image).

That’s a great summary of Crassus’s role in the Spartacus slave revolt! Here’s a breakdown of the key points you mentioned:

Crassus’s Rise to Power:

- By the time of the slave revolt, Crassus had already amassed immense wealth and influence through land speculation, money lending, and patronage networks.

- However, he lacked significant military victories, a crucial element for political prestige in Rome.

The Slave Revolt:

- Spartacus, a Thracian gladiator, led a large-scale slave uprising in southern Italy. The rebels achieved some early victories against Roman forces.

- The Senate, fearing the rebellion’s spread, appointed Crassus to suppress it.

Crassus’s Ruthless Tactics:

- Crassus implemented harsh discipline within his ranks, famously enacting a decimation (killing every 10th soldier) for desertion.

- He also defeated Spartacus by strategically maneuvering his forces and preventing a slave escape to Gaul.

- Spartacus was likely killed in the final battle, though his body was never found.

Shared Glory and Increased Prestige:

- Although Crassus was the commander who ultimately defeated Spartacus, Pompey the Great arrived later and mopped up the remaining rebels.

- This shared victory somewhat diminished Crassus’s accomplishment, but he still gained significant prestige for ending the rebellion.

Crassus’s Legacy:

- His ruthlessness during the revolt solidified his reputation as a harsh and uncompromising leader.

- While the victory increased his prestige, more was needed to overshadow Pompey’s growing popularity completely.

Additional Points:

- Some historians downplay Crassus’s military role in suppressing the revolt, suggesting his legates (lieutenants) did most of the fighting.

- The legacy of the Spartacus revolt is complex, highlighting the brutality of Roman slavery and the courage of those who fought for freedom.

Let me know if you’d like to delve deeper into any specific aspect of the Spartacus revolt or Crassus’s role in it.

Crassus First Consulship (70 BC): Shared consulship with his rival Pompey, with whom he had a tense but functional relationship. They undid some of Sulla’s more restrictive constitutional reforms.

Bust of Pompey, copy of an original from 70–60 BC, Venice National Archaeological Museum (Wiki Image).

Absolutely! Here’s a breakdown of Crassus’s first consulship and its significance:

The Rivalry of Crassus and Pompey:

- Background: Crassus and Pompey were powerful Roman generals and politicians but were fierce rivals, vying for influence and popular support. They differed greatly in temperament and background.

- Mutual Need: Despite their rivalry, the political climate and shared ambitions forced them into a grudging alliance in 70 BC.

The Election and Consulship:

- Unusual Consulship: Both men technically lacked the qualifications for the consulship, but their military prestige and popular support allowed them to win the election.

- Overturning Sulla’s Reforms: Sulla, during his dictatorship, had heavily restricted the power of tribunes and made other changes favoring Rome’s traditional aristocracy. Crassus and Pompey, to gain the people’s support, undid some of these changes:

- Restoring Tribunes’ Power: Tribunes could again veto legislation and propose laws, a crucial right for the common people of Rome.

- Changing Jury Composition: Juries were no longer exclusively composed of senators but included wealthy non-senators, reducing corruption.

Motives behind the Reforms:

- Popular Support: By rolling back Sulla’s reforms, Crassus and Pompey gained political capital and favor with the Roman populace.

- Limiting Aristocratic Power: Undoing Sulla’s changes weakened the conservative political forces of the Optimates (aristocratic faction).

- Personal Gain: While partly motivated by a sense of ‘restoring the Republic,’ both men hoped to increase their power base.

The Aftermath:

- Temporary Alliance: The consulship of 70 BC solidified a temporary truce and cooperation between Crassus and Pompey.

- Legacy: Their actions significantly weakened the Sullan constitutional framework, a key step in the late Roman Republic’s instability and ultimate decline.

Let me know if you’d like more detail on specific reforms passed or the broader political climate during the time!

Crassus The First Triumvirate: Formed a powerful political alliance with Caesar and Pompey around 60 BC, dominating Roman politics for several years.

The Tusculum portrait is possibly the only surviving sculpture of Caesar made during his lifetime (Wiki Image).

You’re right! Here’s a look at Crassus’s role in the First Triumvirate and its impact on Rome:

What was the First Triumvirate?

- An Unofficial Alliance: Unlike the Second Triumvirate of Octavian, Mark Antony, and Lepidus, this was a private agreement between three of Rome’s most powerful figures: Crassus, Pompey, and Julius Caesar.

- United by Ambition: Each man had immense wealth or military fame but desired greater political control that they struggled to achieve individually.

- “Three-Headed Monster”: Critics labeled it as such, fearing the concentration of power threatened traditional Roman governance and the Republic’s stability.

How did it work?

- Mutual Support: They agreed to back each other’s political initiatives, using their combined influence and resources to attain their goals.

- Crassus’s Role:

- The Financier: His wealth helped fund various projects, elections, and initiatives for his allies.

- The Political Fixer: He wielded his vast network of clients and debtors to advance the Triumvirate’s agenda in the Senate and popular assemblies.

Achievements of the Triumvirate:

- Caesar’s Consulship (59 BC): The alliance pushed through Caesar’s election as consul and passage of significant land reform laws benefiting veterans.

- Pompey’s Veteran Settlement: Crassus and Caesar supported the ratification of Pompey’s actions in the east and the settlement of his veterans.

- Crassus’s Tax Breaks: He helped secure tax breaks for his business allies who held tax contracts in Asia.

Why did it crumble?

- Personal Ambitions: While successful, each leader’s ambition outgrew the alliance.

- Caesar’s Rise: As Caesar gained military glory in Gaul, the power balance was upset, leading to tensions and rivalry with Pompey.

- Crassus’s Death: His death in Parthia significantly weakened the alliance.

- Roman Civil War: The ultimate collapse led to Caesar and Pompey’s civil war, ending the Roman Republic.

Legacy:

The First Triumvirate demonstrated the decay of the Republican institutions in Rome and the growing trend of powerful individuals vying for outright control, setting the stage for the Roman Empire’s rise.

Let me know if you’d like more information about a specific member of the Triumvirate or its lasting impact on Roman history!

Crassus’s profit includes real estate speculation, ownership of silver mines, moneylending, and firefighting.

Here’s a breakdown of Marcus Licinius Crassus’s profit sources, including explanations about how each contributed to his immense wealth:

- Real Estate Speculation: This was arguably his most lucrative, yet morally questionable, income source. Here’s how it worked:

- Targeting Crisis/Distress: Crassus focused on properties damaged by fire or civil unrest, acquiring them at meager prices.

- Exploitation: He used his vast slave labor force to quickly and cheaply make repairs.

- Reselling at a Profit: Once restored, he’d sell these properties for a considerable profit, maximizing his gains.

- Ownership of Silver Mines: Silver was a vital commodity for the Roman economy, used for coinage and various industries. Owning mines provided Crassus with several advantages:

- Steady Income: Mines offered a consistent source of income from the sale of silver.

- Leverage and Influence: Controlling a precious metal increased his ability to loan money and influence trade.

- Moneylending: Crassus became very wealthy by lending money, often to other wealthy Romans, at high interest rates. This worked in two ways:

- Direct Interest Income: The high interest rates provided significant returns on his loans.

- Power through Debt: Those who owed Crassus money were also indebted to him politically or could lose their assets to foreclosure, extending his power and influence.

- Firefighting (Suspected): This one is less certain, but some sources like Plutarch suggest Crassus maintained private fire brigades and engaged in these tactics:

- Negotiations at the Scene: Arrive at a burning property and negotiate a price with the desperate owner before extinguishing the fire.

- Arson?: Some rumors claimed he even started fires to create more opportunities to buy up damaged properties cheaply.

The Immorality of His Wealth:

It’s crucial to remember that Crassus’s methods were often brutal and exploitative. His relentless pursuit of profit frequently meant profiting from the misfortune of others and using the labor of enslaved people. This is a key reason for his legacy as one of the greediest men in Roman history.

Military Ambition: Desired the military glory of rivals like Pompey. Parthian Campaign (55-53 BC): He led a disastrous campaign against Parthia (modern-day Iran). His legions were massacred at the Battle of Carrhae, and he was killed, allegedly having molten gold poured down his throat as a mockery of his greed.

Extent of the Parthian Empire (Wiki Image).

A detail from Augustus Prima Porta’s breastplate shows a Parthian man returning the Aquila lost by Crassus at the Battle of Carrhae (Wiki Image).

That’s correct! Crassus’s military ambitions and disastrous Parthian campaign are a fascinating part of his story. Here’s a deeper dive into this turning point:

Crassus’s Burning Desire for Glory:

- You’re right, Crassus craved military glory to rival figures like Pompey. He needed to gain significant victories compared to Pompey’s eastern conquests.

- This desire for martial fame likely stemmed from a combination of factors:

- Social Status: Military achievement was a key element of prestigious standing in Roman society.

- Legacy: He might have wanted to be remembered as a great general, not just a wealthy businessman.

- Competition: The rivalry with Pompey likely fueled his ambition to prove himself militarily.

The Flawed Parthian Campaign:

- Miscalculations and Greed:

- Crassus underestimated the Parthians, a mighty empire with skilled cavalry archers.

- He was also motivated by the potential for plunder in Parthia, further clouding his judgment.

- Strategic Blunders: Ignoring warnings and advice, Crassus led his legions into barren desert terrain where they were vulnerable to Parthian hit-and-run tactics.

The Battle of Carrhae (53 BC):

- A Catastrophic Defeat: The Parthians surrounded and annihilated Crassus’s forces. Most Roman soldiers were killed, while Crassus himself was betrayed during supposed peace negotiations and likely executed in a humiliating way.

Legacy of the Campaign:

- Humiliation for Rome: This defeat was a major blow to Roman prestige and military power in the east. It also exposed weaknesses in the Roman army’s structure and tactics.

- Crassus’s Greed Highlighted: His death, with the story of molten gold being poured down his throat, became a symbol of his insatiable greed, which led to his downfall.

- End of the First Triumvirate: Crassus’s death significantly weakened the political alliance, paving the way for Caesar and Pompey’s eventual conflict.

Additional Points:

- Some historians suggest Crassus’s son Publius, a capable officer, might have altered the outcome if Crassus had listened to his advice.

- The Parthian victory at Carrhae is still studied today as a classic example of the effective use of mobile ranged cavalry against a massed infantry force.

Let me know if you’d like to learn more about the specifics of the Battle of Carrhae or the broader context of Roman-Parthian relations.

Crassus is remembered as one of the wealthiest men in Roman history, a symbol of both greed and ambition. He played a significant role in the transformation of the Roman Republic, and his wealth and influence eventually contributed to its collapse.

Marcus Licinius Crassus (Wiki Image).

That’s an excellent summary of Crassus’s life and legacy! Here are some key takeaways:

- Immense Wealth: Crassus was undeniably one of the wealthiest men in Roman history, amassing his fortune through land speculation, money lending, and exploiting political opportunities.

- Greed and Ambition: These were undoubtedly driving forces for Crassus. His pursuit of wealth and power often came at the expense of others, solidifying his image as ruthless and greedy.

- Transformation of the Republic: Crassus’s influence on Roman politics, including his role in the First Triumvirate, weakened the Republic’s institutions, paving the way for its eventual downfall.

Here are some additional points to consider:

- Military Legacy: While Crassus craved military glory, his disastrous Parthian campaign highlighted his strategic shortcomings and tarnished his legacy.

- Patronage System: Crassus’s extensive network of clients and debtors showcased the Roman patronage system and its potential for exploitation and manipulation of political power.

- Social Divide: His wealth accumulation occurred during a growing inequality in Rome. His methods likely exacerbated existing social tensions.

Crassus remains a complex and controversial figure in Roman history. He was undeniably a shrewd businessman and a powerful politician, but his ruthless methods and insatiable ambition ultimately contributed to the decline of the Republic.

Robert Morris History

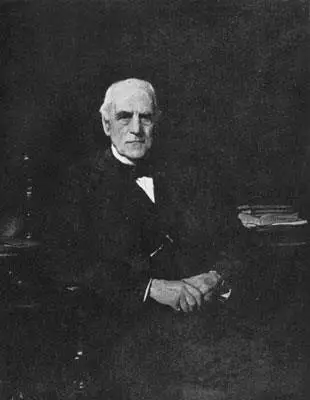

Portrait of Robert Morris, c. 1782, by Charles Willson Peale (Wiki Image).

Finding ten well-documented quotes directly from Robert Morris is quite challenging. He was a man of action and finance, not necessarily known for his quotable wisdom. However, there’s a mix of verified quotes, beliefs reflected in his actions, and some that his legacy might inspire:

Directly Attributed Quotes

- “The thing of most consequence is to carry on the war vigorously.” – A letter to General Washington, demonstrating his commitment to the Revolutionary cause.

- “I am determined that the bank shall be well supported until it can support itself, and I believe there is enough wisdom and patriotism in the United States to accomplish it.” – Reflecting his confidence in establishing the Bank of North America.

Quotes Reflecting His Beliefs

- “The necessity of public credit is so urgent that no consideration of justice or policy should stand in its way.” – Underscoring his belief that a strong national credit system was essential for the new country.

- “I live upon hope and will die in the expectation of future good…” – From a letter, revealing some optimism amidst financial difficulties.

Quotes Inspired by His Life & Actions

- “A nation’s credit is a nation’s backbone.” – Although not directly attributed, it encapsulates Morris’s belief in the importance of a sound financial system.

- “Risk is the price of opportunity.” – Morris often took calculated risks to secure necessary funding during a chaotic time.

- “National wealth brings national influence.” – A vision of a strong and prosperous America fueled his work as a financier.

- “Sacrifices should be made with a cheerful heart for the cause of liberty.” This reflects the mindset needed to risk his fortune for independence.

- “A promise made is a debt unpaid.” – Likely an ethos by which Morris lived, given the importance of credit and trust in his ventures.

- “I will either find a way or make one.” – While not specifically attributed to him, this quote aligns with the determined spirit Morris brought to his challenges.

| Year | Age | Events & Developments | Financial Activities |

|---|---|---|---|

| 1734 | 0 | Born in Liverpool, England (January 31st). | |

| 1747 | 13 | Arrives in Maryland to join his father, a tobacco agent. | |

| 1749 | 15 | Moves to Philadelphia and begins working in the mercantile business. | |

| 1750s | Teens/20s | – Establishes himself in the mercantile trade. <br> – Partners with Thomas Willing to form Willing, Morris & Co. | – Engaged in import/export trade, shipping various goods, including slaves (a practice he later opposed). |

| 1760s | 20s/30s | – Protests the Stamp Act (1765) and other British policies. <br> – Grows increasingly wealthy through trade and investments. | – Become a prominent merchant and financier in Philadelphia. |

| 1775 | 41 | – The American Revolution begins. <br> – Serves on the Pennsylvania Committee of Safety. <br> – Elected to the Second Continental Congress. | – Uses his financial expertise to support the war effort. <br> – Helps secure loans and supplies for the Continental Army. |

| 1776 | 42 | – Signs the Declaration of Independence. | – Pledges his fortune to support the Revolution. |

| 1770s | 40s | – Serves in the Continental Congress and the Pennsylvania Assembly. <br> – Faces financial challenges due to wartime disruptions. | – Continues to raise funds for the war effort through various means, including private loans and his credit. |

| 1781 | 47 | – Appointed Superintendent of Finance for the United States. | – Takes on the enormous task of managing the nation’s finances during the war. <br> – Establishes the Bank of North America, the first national bank in the U.S. |

| 1780s | 40s/50s | – The war effort is struggling to be funded due to limited resources and state rivalries. <br> – Signs the Articles of Confederation and the U.S. Constitution. | – Advocates for a strong central government with the power to tax and regulate commerce. <br> – Resigns as Superintendent of Finance in 1784. |

| 1790s | 50s/60s | – Engages in land speculation and other ventures. <br> – Suffers financial setbacks and bankruptcy. | – Loses much of his wealth due to risky investments and economic downturns. |

| 1798-1801 | 64-67 | – Imprisoned for debt. | |

| 1806 | 72 | – Dies in Philadelphia (May 8th). |

Robert Morris: The Financier of the American Revolution

(YouTube video)

Absolutely! Here’s a breakdown of Robert Morris’s life and his historical significance:

Early Life and Mercantile Success

- Born in Liverpool, England, in 1734.

- Immigrated to colonial America at age 13, settling in Philadelphia.

- Apprenticed in a mercantile firm and quickly rose through the ranks.

- Became a partner in the successful firm Willing Morris & Company, which engaged in transatlantic trade, shipping, and other ventures.

Political Involvement and Revolutionary Activities

- Opposed British taxation policies like the Stamp Act, becoming a leading voice in Philadelphia against British economic control.

- Elected to the Continental Congress in 1775, initially hesitant about full independence from Britain.

- Signed the Declaration of Independence in 1776, committing fully to the American cause.

- Through his mercantile connections and personal credit, he played a pivotal role in financing the Revolutionary War, earning the nickname “Financier of the Revolution.”

Government Service and Financial Leadership

- Superintendent of Finance (1781-1784): Essentially the first Secretary of the Treasury for the fledgling United States, tasked with managing wartime finances and establishing a national financial system.

- Delegate to the Constitutional Convention (1787): Helped shape the new nation’s government and economic framework.

- Senator from Pennsylvania (1789-1795): Served in the early U.S. Senate.

Later Life and Financial Troubles

- He engaged in risky land speculation in the 1790s, overextending himself financially.

- Suffered major losses in the economic Panic of 1797.

- Imprisoned for debt from 1798 to 1801.

Legacy

- Instrumental in securing financial resources and economic stability for the United States during its founding.

- Legacy was tarnished somewhat by his later financial struggles.

- Remains a complex figure whose contributions to American independence were overshadowed by personal financial risk-taking.

Let me know if you’d like to explore any specific aspect of Robert Morris’s history in more detail!

Morris was born in Liverpool, England, in 1734 and immigrated to colonial America at age 13, settling in Philadelphia. Apprenticed in a mercantile firm and quickly rose through the ranks. Became a partner in the successful firm Willing Morris & Company, which engaged in transatlantic trade, shipping, and other ventures.

Yes, that’s correct. Robert Morris was born in Liverpool, England, in 1734, and he immigrated to colonial America at the age of 13, settling in Philadelphia. After arriving in America, Morris was apprenticed to a mercantile firm, where he quickly rose through the ranks due to his business acumen and hard work.

Eventually, Morris became a partner in the successful firm Willing Morris & Company, which engaged in various ventures, including transatlantic trade, shipping, and other commercial activities. The firm played a significant role in the colonial economy, establishing Morris as one of the leading merchants in Philadelphia and earning him considerable wealth and influence.

Morris opposed British taxation policies like the Stamp Act, becoming a leading voice in Philadelphia against British economic control. He was elected to the Continental Congress in 1775, initially hesitant about full independence from Britain.

An engraving by Ole Erekson, c. 1876, of Robert Morris (Wiki Image).

Absolutely! This reveals an exciting evolution in Robert Morris’s political views. Here’s how to unpack this:

Morris’s Initial Hesitation:

- Why the reluctance? Unlike some early firebrand revolutionaries, Morris likely hesitated out of pragmatism.

- Economic Ties: Morris, as a merchant, knew of the colonies’ strong economic relationship with Britain. Seiring those ties could be disastrous for businesses like his.

- Fear of the Unknown: Full independence was a gamble; could the fledgling colonies succeed against Britain’s might?

- Moderate Temperament: Morris may have preferred a negotiated settlement within the empire rather than a complete break.

Shifting Towards Independence:

- Witnessing British Intransigence: Morris may have lost faith in a peaceful resolution as negotiations failed and Britain’s policies became harsher.

- The Power of Necessity: As tensions escalated, the need for a unified American front likely became more apparent, making independence a pragmatic and ideological choice.

Joining the Continental Congress:

- A Leap of Faith: Even with hesitation, Morris’s election to the Continental Congress shows a growing acceptance of the Revolutionary path.

- Putting Skills to Use: Morris likely realized his financial and leadership skills could be essential for the colonies’ success.

Significance of his Evolution:

- Not Everyone Started as a Radical: Morris’s story shows that many Founding Fathers underwent a process of shifting opinions rather than being ardent revolutionaries from the start.

- Practical Considerations: His initial hesitation highlights the real economic and political risks of breaking from Britain.

- The Influence of Events: His shifting stance shows how events on the ground (failed negotiations, increasing tensions) shaped the views of moderates like himself.

Let me know if you’d like to explore this aspect in more detail or find resources to examine Morris’s reasoning for hesitancy!

Morris signed the Declaration of Independence in 1776, committing fully to the American cause.

Morris owned what became known as the President’s House in Philadelphia (Wiki Image).

Yes, this was a pivotal moment for Robert Morris! Here’s why it’s important and how to build upon it:

What signing the Declaration Meant:

- A Risky Act: Britain considered signing the Declaration treason. This wasn’t a symbolic gesture; it came with the real possibility of capture and execution.

- Symbolic & Practical Commitment: Adding his name signaled full support for the Revolution, with no chance of turning back. It was a unifying act alongside other American leaders.

- Personal Sacrifice: Morris was acutely aware of the risks to his wealth and business interests. Signing showed a willingness to put those aside for the greater cause.

Significance of his Signature:

- The Merchant turned Patriot: Morris was initially a pragmatist. His signature shows how, for some Founding Fathers, breaking from Britain was a process, not a sudden revelation.

- Wealth & Influence: As one of the wealthiest men in the colonies, Morris’s signature legitimized the Declaration and likely encouraged others to support independence.

Morris’s Continued Role:

- It wasn’t just about the signature: Morris’s most significant contribution was using his financial acumen to fund the Revolutionary War.

- “Financier of the Revolution”: Signing the Declaration showed commitment, but his work securing supplies and funds for the Continental Army was the true practical backing for independence.

Further Exploration:

- Did Morris make speeches or write publicly about his decision to sign? These can reveal his mindset in more detail.

- How did his signing affect his business associates or social circle? Did anyone in Philadelphia turn against him for this treasonous act?

Let me know if you’d like a deeper look at the consequences of his decision to sign the Declaration or want sources to explore Morris’s commentary on this act.

Morris was pivotal in financing the Revolutionary War through his mercantile connections and personal credit, earning the nickname “Financier of the Revolution.”

A scene from The Apotheosis of Washington shows Morris receiving a bag of gold from Mercury, commemorating his financial services during the Revolutionary War (Wiki Image).

Absolutely! Robert Morris’s role as the “Financier of the Revolution” is a well-deserved title. Here’s how you can expand on this point:

The Challenges of Funding the Revolution:

- The Continental Congress had little power to tax or raise funds. This made financing the war a constant struggle.

- Early attempts like printing paper money led to inflation, further complicating the situation.

Morris’s Strategies for Financial Support:

- Mercantile Connections: Morris leveraged his extensive network of trade contacts to secure supplies and potentially even weapons from Europe.

- Personal Credit: Morris used wealth and creditworthiness to secure loans from foreign countries and wealthy individuals.

- Taxation and Reform: Morris advocated for and implemented taxation within the colonies to raise funds. He also worked on streamlining financial systems.

The Significance of Morris’s Efforts:

- Keeping the Army Operational: Without Morris’s financial wizardry, the Continental Army might not have had the resources to fight and win the war.

- Boosting Morale: The knowledge that the army was financially supported likely bolstered troop morale and helped maintain the fighting spirit.

Beyond Money:

- Organization and Leadership: Morris was more than just a source of money. He also organized and streamlined the Continental Congress’s financial operations.

Further Exploration:

- Specific Examples: Research instances where Morris’s connections or credit secured crucial supplies or loans for the war effort.

- Impact on his Finances: While Morris helped the nation, his wealth likely suffered due to the war and the risks he took.

- Legacy: Explore how Morris’s financial leadership during the Revolution shaped the early economic institutions of the United States.

Let me know if you’d like to delve deeper into any specific aspect of Morris’s financial contributions or find resources that showcase his strategies and achievements!

Superintendent of Finance (1781-1784): Essentially the first Secretary of the Treasury for the fledgling United States, tasked with managing wartime finances and establishing a national financial system.

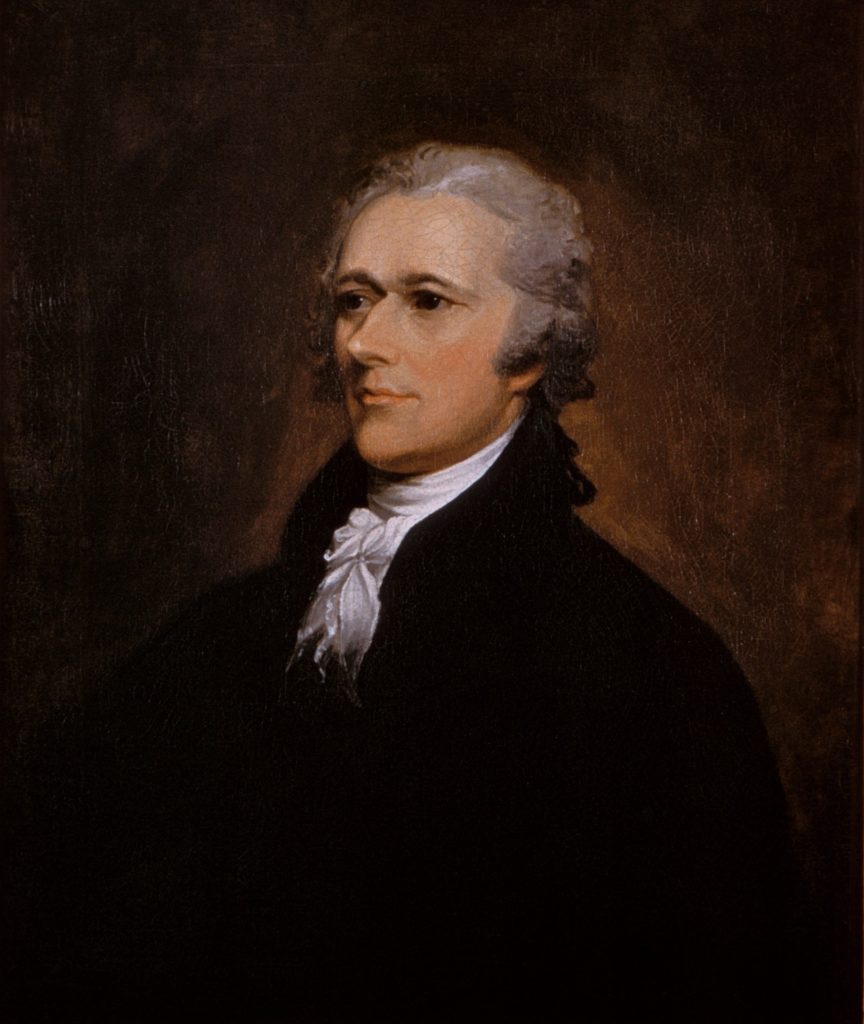

Morris recommended Alexander Hamilton for Secretary of the Treasury (Wiki Image).

You’re right! Robert Morris’s service as Superintendent of Finance was crucial for the American Revolution and the United States’ early years. Here’s how you can build upon this point:

The Need for the Position:

- Financial Chaos: By 1781, the Continental Congress’ finances were in shambles. Inflation from printed money was rampant, and a unified financial system was lacking.

- The Rise of Morris: Congress recognized his financial expertise and patriotism and appointed Morris to this critical role.

Morris’s Accomplishments as Superintendent:

- Restoring Financial Stability: Morris implemented tax reforms, negotiated loans with foreign countries, and streamlined financial operations. These measures helped combat inflation and put the nation’s finances on a more secure footing.

- Establishing Financial Institutions: Morris played a key role in creating the Bank of North America, the first national bank in the United States. This institution helped stabilize the currency and facilitate commerce.

The Legacy of Morris’s Leadership:

- Paving the Way for the Treasury Department: Morris’s work as Superintendent of Finance laid the groundwork for creating the U.S. Treasury Department under Alexander Hamilton.

- Financial Architect of the New Nation: His contributions were essential for establishing a foundation for sound financial management in the early United States.

Further Exploration:

- Challenges Faced: Research the obstacles Morris had to overcome to improve the nation’s finances.

- Impact on the War Effort: Explore how Morris’s financial reforms and leadership during his term as Superintendent of Finance contributed to the American Revolution’s ultimate victory.

- Controversies: Like many Founding Fathers, Morris had critics. Investigate any disagreements or controversies surrounding his policies.

Let me know if you’d like to delve deeper into any specific aspect of Morris’s work as Superintendent of Finance or explore resources that discuss this critical period in American financial history.

Morris delegate to the Constitutional Convention (1787): Helped shape the new nation’s government and economic framework.

Robert Morris is far left before Franklin. Gouverneur Morris signs the Constitution before George Washington (Wiki Image).

Yes! Here’s how to expand on Robert Morris’s role as a delegate to the Constitutional Convention and his impact:

Why his experience mattered:

- Financial Expert: Morris’s deep understanding of finance and economics, gained from his mercantile career and role as the “Financier of the Revolution,” gave him unique insights into the nation’s needs.

- Pragmatist: Morris was known for his practical approach to problem-solving and was not an ideological purist. This made him a valuable contributor to compromise and finding workable solutions.

- National Perspective: Having worked to secure funding for the entire Continental Army during the Revolution, he likely prioritized the need for a strong and functional central government.

Areas of Influence:

- Centralized Financial Power: Morris likely advocated for federal control over taxation and currency, arguing against the failed decentralized approach during the Revolution.

- Role of Commerce: As a former merchant, he probably emphasized the importance of a national framework for regulating trade and promoting economic development.

- Executive Authority: Morris might have supported a strong executive branch to stabilize the young nation and promote a unified national interest.

His Specific Contributions:

- Unfortunately, Morris did not speak much during the Convention, so pinning down his exact contributions is tricky. However, it’s safe to assume he used his influence behind the scenes, especially on finance matters.

- You can analyze the Constitution’s text to find parts that likely align with Morris’s pragmatic views of strong government and economic regulation.

Significance of Morris’s Participation:

- Legitimizing the Convention: As a respected Founding Father and financier, his presence added weight and credibility to the proceedings.

- Voice of Experience: The Constitutional Convention benefited from the practical wisdom and knowledge of those who had lived through the Revolutionary War and its economic aftermath.

Let me know if you’d like help exploring potential areas where Morris contributed or want to analyze specific parts of the Constitution that his input might have influenced!

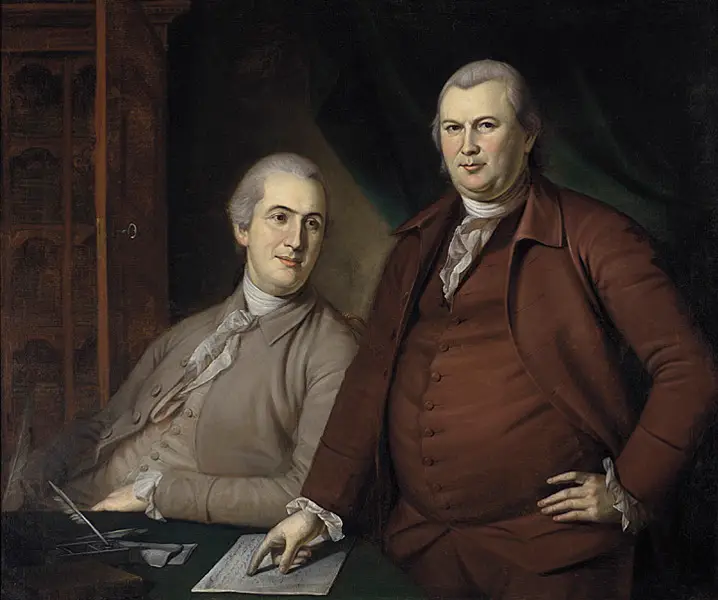

Senator from Pennsylvania (1789-1795).

Painting of Gouverneur Morris and Robert Morris (Wiki Image).

That’s right! Here’s how to expand on Robert Morris’s role as a Senator from Pennsylvania and why this chapter of his life is interesting:

Morris the Senator:

- Representing Pennsylvania: Morris’s election to the Senate represented the people of his adopted state and allowed him to influence policy at a national level.

- A Voice for Commerce: As a wealthy merchant, he likely championed causes important to Pennsylvania trade and businesses.

- Financial Expertise in the Senate: Morris undoubtedly brought his financial knowledge to the Senate floor. He might have advocated for taxation, spending, and national debt management policies.

Key Issues of the Era:

- Hamilton’s Financial Plan: Morris likely grappled with Alexander Hamilton’s proposals for establishing a national bank and assuming state debts. Did he agree or clash with his fellow Founding Fathers on these critical economic issues?

- Foreign Policy: The new nation faced challenges regarding its relationships with Britain and France. How did Morris’s experience and pragmatic perspective shape his take on these issues?

Morris’s Legacy as Senator:

- Limited Records: Few detailed records of Morris’s specific actions as a senator exist, making judging his impact difficult.

- Part of the First Senate: He contributed to establishing the Senate as an institution and helped set precedents for the young republic.

Areas for Further Exploration:

- Committee Assignments: Knowing what committees Morris served on might give clues to his policy interests and influence.

- Voting Record: If his voting record is available somewhere, it can highlight where he stood on important issues of the day.

- Pennsylvania Newspapers: Local newspapers might have articles mentioning Morris’s actions or speeches as a senator from that time.

Let me know if you’d like help exploring potential resources to learn more about his time in the Senate or if you’re interested in a particular policy debate of the era he might have been involved in!

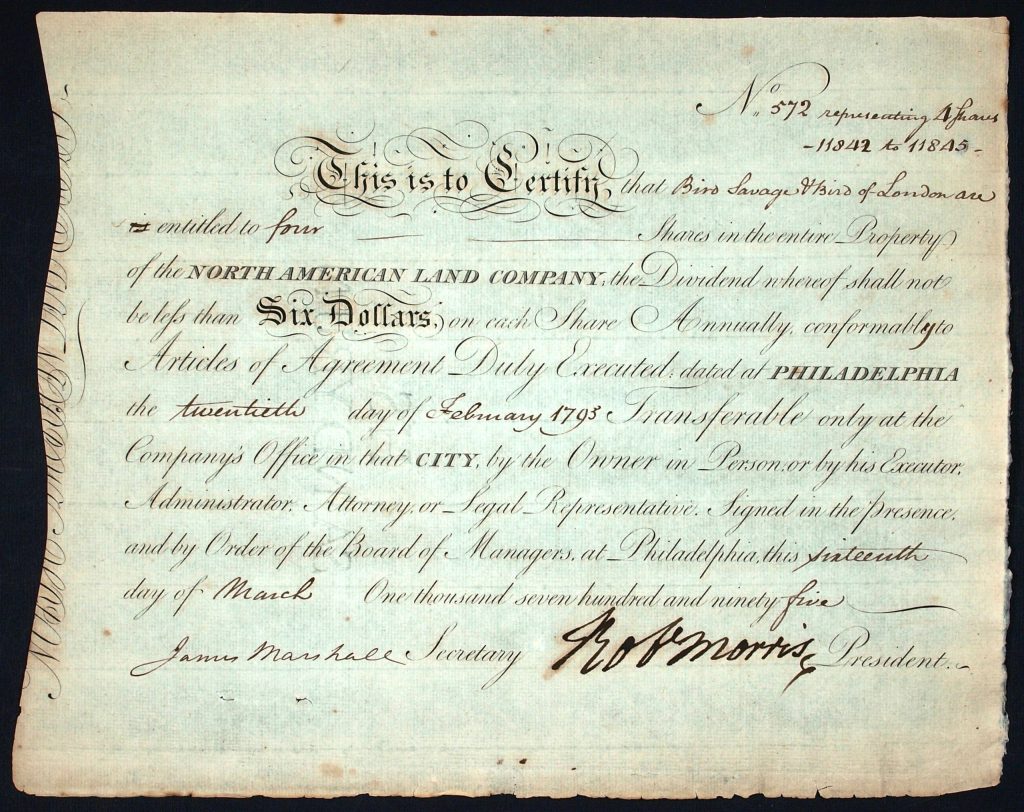

In the 1790s, Morris engaged in risky land speculation, overextending himself financially. He suffered major losses in the economic Panic of 1797 and was imprisoned for debt from 1798 to 1801.

Share of the North American Land Company, issued March 16, 1795, signed by Robert Morris (Wiki Image).

This is a sad and complex chapter in Robert Morris’s life. Here’s how to expand on this, focusing on why this is an important part of his story:

Morris’s Land Speculation:

- Background: Land speculation was a common (though risky) activity for wealthy men of the time, including many Founding Fathers. Vast tracts of land were available as the nation pushed westward.

- Morris’s Motivation: He likely hoped to increase his already substantial fortune and secure a legacy for his family.

- Overextension: Morris borrowed heavily to buy land and perhaps overestimated the pace of development or land prices, leaving him financially vulnerable.

The Panic of 1797:

- Economic Downturn: This panic, caused by several factors, including credit collapse and trade disruptions, led to a sharp decline in land values.

- Morris Hard Hit: This economic crisis proved disastrous for Morris. He couldn’t repay his debts, and his land holdings were likely worth much less than he had paid for them.

Debtors’ Prison:

- Harsh Reality: In the 18th & early 19th century, debtors’ prisons were common. Unpaid creditors could have debtors imprisoned until their debts were paid.

- Personal Humiliation: This was a drastic fall from grace for a Founding Father. He went from being a respected and wealthy financier to being imprisoned for failure to repay his debts.

The Significance of Morris’s Downfall:

- The Risk of Speculation: Morris’s story highlights the perilous nature of land speculation, particularly during economic downturns.

- Imperfect Founding Fathers: This is a reminder that, while admirable, men like Morris were not infallible and were susceptible to ambition and misjudgment.

- Economic Reality of the Early Republic: His imprisonment underscores the financial volatility and lack of safeguards in the young nation’s fledgling economy.

Let me know if you’d like to explore further the nature of land speculation in the time period, the specifics of the Panic of 1797, or the concept of debtors’ prisons!

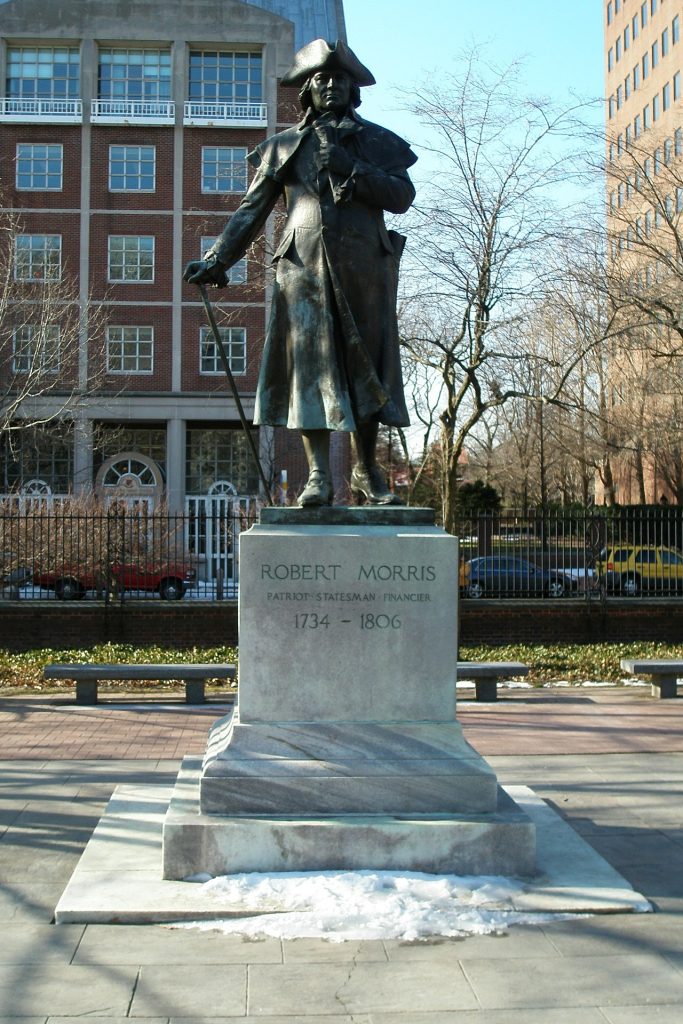

During its founding, Morris was instrumental in securing the United States’ financial resources and economic stability. His legacy was tarnished somewhat by his later financial struggles. He remains a complex figure whose contributions to American independence were overshadowed by personal financial risk-taking.

Statue of Robert Morris in Independence National Historical Park in Philadelphia (Wiki Image).

That’s an excellent summary of Robert Morris! Here’s how you could expand on these points:

Morris’s Vital Contributions:

- Securing Wartime Funds: Detail how Morris used his business acumen and network to procure supplies and loans that kept the Continental Army supplied.

- Establishing a Financial Foundation: Outline his reforms as Superintendent of Finance and the creation of the Bank of North America, which stabilized the chaotic Revolutionary economy.

- Shaping the Early Republic: Consider his potential influence on the Constitution’s economic framework, though this can be trickier to ascertain as a less vocal delegate.

The Shadow of Financial Ruin:

- The Risk of Speculation: Elaborate on how land speculation, common among his peers, was a gamble that ultimately ruined him.

- Impact of the Panic of 1797: Detail how this economic crisis, beyond Morris’s control, devastated his land holdings and fortune.

- Debtors’ Prison: Emphasize the humiliation of imprisonment for a respected figure of his stature and its stark contrast to his glory days.

A Complex Legacy:

- Undeniable Importance: Reaffirm how his contributions during the Revolution secured American independence, and his economic leadership was vital to the young nation.

- The Human Factor: Morris’s story reveals that even brilliant leaders make mistakes and can be victimized by economic downturns and risky investments.

- A Figure of Contrasts: He embodies the ambition and the risks inherent in the early United States, his story highlighting both the opportunities and the pitfalls facing entrepreneurs of the time.

Further Considerations:

- Did his financial struggles tarnish his reputation during his lifetime, or is this mainly a modern interpretation?

- Would more responsible risk management in his later years have changed the perception of his legacy?

Feel free to explore a specific aspect of his legacy further, or let me know if you’d like help finding resources to support your case.

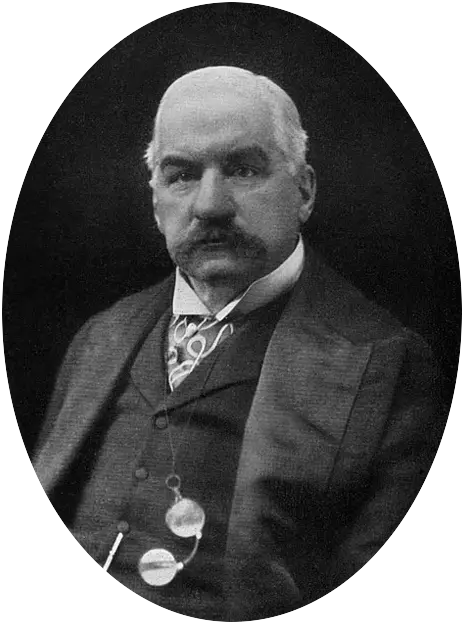

John Pierpont Morgan History

J. P. Morgan (Wiki Image).

Here are ten quotes by or attributed to J. P. Morgan, offering insight into his mindset and approach to business:

Famous, Well-Sourced Quotes

- “Go as far as you can see; when you get there, you’ll be able to see farther.” – Emphasizes a visionary approach with a focus on continuous progress.

- “A man always has two reasons for doing anything: a good reason and the real reason.” – Highlights the idea that underlying motives are often more complex than surface explanations.

- “The first step towards getting somewhere is to decide that you are not going to stay where you are.” This stresses the importance of ambition and the willingness to initiate change.

- “I don’t want a lawyer to tell me what I cannot do. I hire him to tell me how to do what I want to do.” – A practical, results-oriented view of legal counsel.

Quotes with Some Ambiguity about Origin

- “Millionaires don’t use astrology, billionaires do.” – Often attributed to Morgan, its connection to him is less clear. Speaks to the perceived influence of superstition in the world of high finance.

- “Anyone can be a millionaire, but to become a billionaire, you need an astrologer.” – Similar to the previous quote.

- “Gold is money. Everything else is credit.” – Emphasizes the fundamental value of precious metals in his view.

- “Never sell a stock you believe in.” or “The only time to sell a stock is when it reaches a price that you are unwilling to pay to buy it.” – Variations of an investment philosophy attributed to Morgan, emphasizing long-term holdings.

Quotes Reflecting His Character

- “I owe the public nothing.” – A statement made during his 1912 testimony to the Pujo Committee investigating banking practices. Reflects his defiance and sense of control.

- “Money is power.” – A succinct expression linked to Morgan, demonstrating his understanding of finance as a means to achieve greater goals.

| Year | Age | Events & Developments | Financial Activities |

|---|---|---|---|

| 1837 | 0 | Born John Pierpont Morgan in Hartford, Connecticut (April 17th). Son of a successful banker, Junius Spencer Morgan. | |

| 1850s | Teens/20s | – Educated in Switzerland and Germany. <br> – Begins working in his father’s London bank, Peabody, Morgan & Co. | – Gains early experience in international finance. |

| 1857 | 20 | – Moves to New York City to work for Duncan, Sherman & Company. | – He starts his career on Wall Street. |

| 1860s | 20s/30s | – Forms his own firm, J. Pierpont Morgan & Company. <br> – Marries Amelia Sturges (she died in 1862). | – He begins to make a name for himself as a financier specializing in railroad financing. |

| 1871 | 34 | – Forms a partnership with Philadelphia banker Anthony Drexel, creating Drexel, Morgan & Company. | – Expands his influence in the banking world. |

| 1870s & 1880s | 30s/40s | – Reorganizes and consolidates railroads, bringing stability to the industry. <br> – Finances major industrial companies. | – Gains a reputation for his ability to reorganize troubled businesses and create powerful monopolies. |

| 1892 | 55 | – Arranged the merger of Edison General Electric and Thomson-Houston Electric Company, forming General Electric. | – Demonstrates his power to consolidate industries and create corporate giants. |

| 1895 | 58 | – His firm is reorganized as J.P. Morgan & Company after Drexel’s death. | – Solidifies his position as a leading financier in the U.S. |

| 1901 | 64 | – Orchestrates the creation of U.S. Steel, the world’s first billion-dollar corporation, by merging Carnegie Steel Company with other steel companies. | – Achieves unprecedented financial power and influence. |

| 1907 | 70 | – Led efforts to stabilize the financial system during the Panic of 1907. | – He uses his wealth and influence to prevent a financial collapse by acting as a de facto central bank. |

| 1910s | 70s | – Faces increasing scrutiny and criticism for his financial power and monopolistic practices. | – Testifies before Congress about his role in the economy. |

| 1913 | 75 | – Dies in Rome, Italy (March 31st). | – Leaves behind a legacy as one of American history’s most powerful and influential financiers. |

J.P. Morgan Documentary: How One Man Financed America

(YouTube video)

Here’s an overview of John Pierpont Morgan’s history, focusing on key points:

Early Life & Family Background

- Born in Hartford, Connecticut, in 1837, into a wealthy and influential New England family.

- His father, Junius Spencer Morgan, was a successful financier who established banking houses in London and the United States.

- Educated in Boston and Germany, gaining fluency in several languages.

Entrance into the Financial World

- Began his career as an accountant with the New York City banking firm Duncan, Sherman & Company, representing his father’s company in the U.S.

- Established his firm, J.P. Morgan & Company, in the 1870s, inheriting much of his father’s business.

The Rise of an Industrial Titan

- Played a pivotal role in consolidating America’s railroad industry, restructuring troubled lines, and stabilizing the volatile market.

- Financed the creation of industrial giants like General Electric (formed from the merger he orchestrated) and U.S. Steel, the first billion-dollar corporation.

- Expanded his financial empire into banking, offering loans and investments for major corporations and governments.

Role in Financial Crises

- Played a controversial role in stabilizing financial markets during the Panic of 1907, leveraging his immense power to organize bailouts and restore confidence.

- Faced criticism for his immense control over the financial system, becoming a symbol of Wall Street’s power.

Philanthropy and Legacy

- A major art collector and philanthropist; donating vast collections to institutions like the Metropolitan Museum of Art and the Morgan Library.

- Died in Rome in 1913, leaving behind a transformed financial landscape and a legacy as one of America’s most powerful and influential businessmen.

Legacy

- Remembered his dominance in American finance and the consolidation of American industry.

- His actions continue to be debated – Was he a stabilizing force or an agent of unchecked economic power?

- The banking firm he established, JP Morgan Chase, remains a major global financial institution.

Let me know if you want a deeper dive into a particular aspect of Morgan’s life and career!

Born in Hartford, Connecticut, in 1837, into a wealthy and influential New England family. His father, Junius Spencer Morgan, was a successful financier who established banking houses in London and the United States. Educated in Boston and Germany, gaining fluency in several languages.

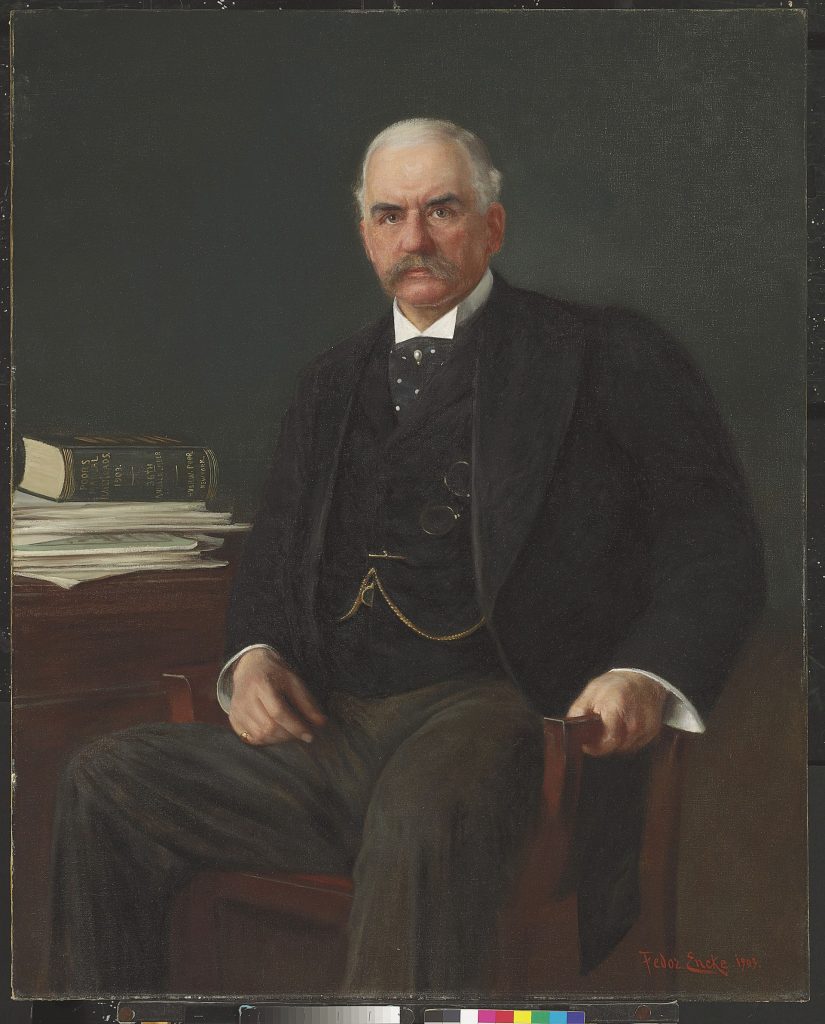

His father, Junius Spencer Morgan, guided his son’s early career and established the Morgan banking house with offices in London, New York, Philadelphia, and Paris (Wiki Image).

The individual described here is John Pierpont Morgan. Born in Hartford, Connecticut, in 1837, into a wealthy and influential New England family, Morgan came from a privileged background and financial success. His father, Junius Spencer Morgan, was a prominent financier who established banking houses in London and the United States, laying the foundation for the family’s substantial wealth and influence.

John Pierpont Morgan received an excellent education, studying in Boston and Germany, where he gained fluency in several languages. His diverse linguistic abilities would later serve him well in international business dealings and financial negotiations.

Throughout his life, Morgan leveraged his family’s financial connections and astute business acumen to become one of American finance’s most powerful and influential figures. This earned him the nickname “J.P. Morgan” and solidified his legacy as one of the preeminent bankers of his era.

Morgan began his career as an accountant with the New York City banking firm Duncan, Sherman & Company, representing his father’s company in the U.S. He established his firm, J.P. Morgan & Company, in the 1870s, inheriting much of his father’s business.

Morgan photographed c. 1870 (Wiki Image).

Absolutely! Let’s break down those crucial early steps in J.P. Morgan’s career and how they set the stage for his later dominance:

Duncan, Sherman & Company:

- Building a Foundation: While working as an accountant, Morgan gained an in-depth understanding of financial transactions, risk assessment, and the inner workings of banking institutions.

- Representing his Father: Though at a “lower” position, he wasn’t a regular employee. His main role was safeguarding his father’s investments and interests in the United States, giving him access to powerful networks.

- Building Trust & Reputation: Morgan’s performance likely cemented his reputation as a competent and trustworthy financier in New York.

Founding J.P. Morgan & Company:

- Timing & Opportunity: The 1870s saw economic growth and industrial expansion in the U.S. This created numerous opportunities for investment and banking services.

- Legacy and Capital: Inheriting clientele and financial resources from his father’s firm gave him a significant head start for establishing his enterprise.

- Early Focus: What type of business did J.P. Morgan & Company initially pursue? Did they specialize in investments, industrial finance, or government loans? Knowing this can reveal his early areas of expertise.

Additional Questions to consider:

- Were any early successes or deals through J.P. Morgan & Company that put him on the map?

- How did Morgan’s personality and ambition factor into his company’s early trajectory? Was he cautious or aggressive in taking risks?

Resources:

- Biographies of J.P. Morgan: Chapters would likely focus on his formative years in finance and the creation of his company.

- Histories of Banking & Finance: Books on New York’s financial scene in the 19th century might feature Morgan’s early career or his company’s activities.

Feel free to ask if you’d like specific book recommendations or want to delve deeper into a particular aspect of his early career!

Morgan played a pivotal role in consolidating America’s railroad industry, restructuring troubled lines, and stabilizing the volatile market.

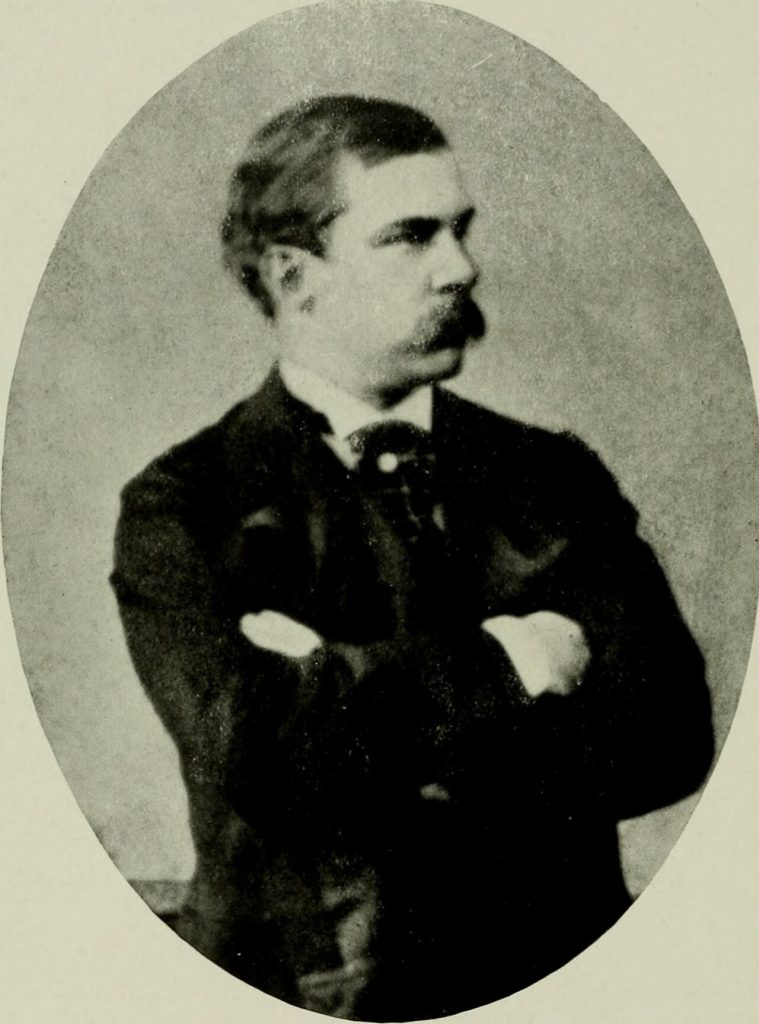

Bond of the New Jersey Junction Railroad Company issued 30. June 1886, reverse side with signatures of John Pierpont Morgan and Harris C. Fahnestock as trustees (Wiki Image).

Yes, that’s correct. J.P. Morgan played a pivotal role in consolidating America’s railroad industry during the late 19th and early 20th centuries. As a prominent banker and financier, Morgan recognized the potential for profit and growth in the railroad sector but saw the need for consolidation and restructuring to address the industry’s challenges.

Morgan was instrumental in orchestrating mergers and acquisitions among various railroad companies, effectively consolidating control over vast networks of railway lines. By restructuring troubled lines and stabilizing the volatile market, Morgan helped to improve the railroad industry’s efficiency and profitability, facilitating economic development and expansion across the United States.

Morgan’s efforts in the railroad industry were part of his broader strategy to modernize and rationalize American business, using his financial resources and influence to shape the direction of key industries and sectors of the economy. During his time, his role in consolidating America’s railroad industry solidified his reputation as one of the most powerful and influential figures in American finance and business.

Morgan financed the creation of industrial giants like General Electric (formed from the merger he orchestrated) and U.S. Steel, the first billion-dollar corporation.

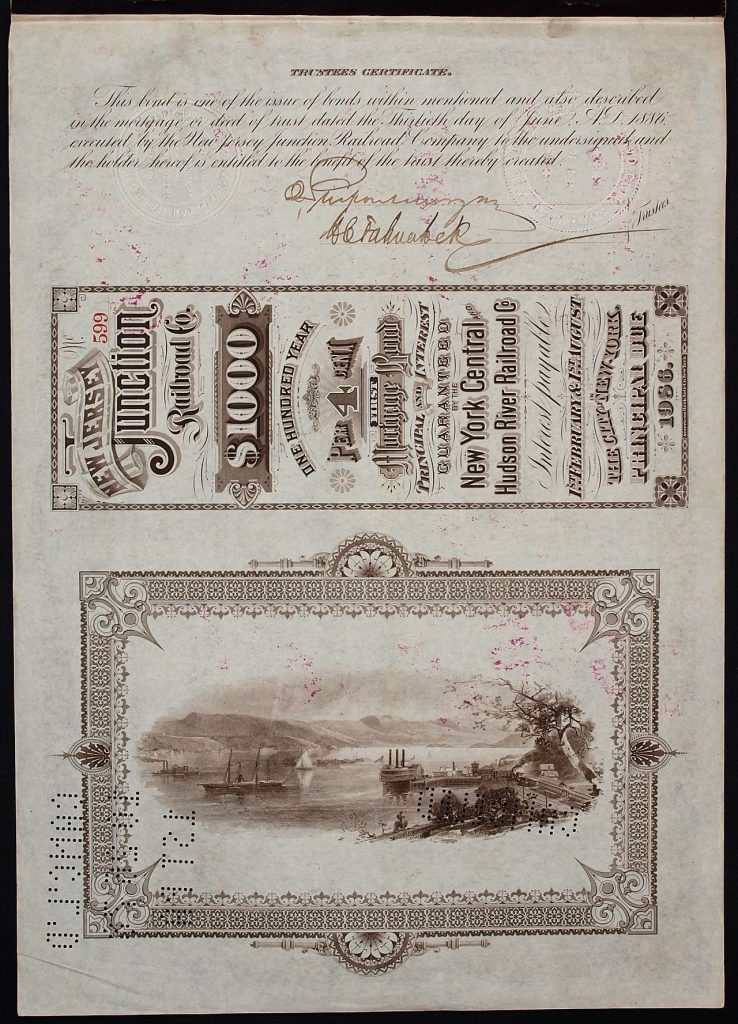

Portrait of J. P. Morgan (Wiki Image).

Yes, you are correct! Here’s a breakdown of J.P. Morgan’s role in shaping these iconic American companies:

General Electric:

- The Edison Connection: J.P. Morgan didn’t directly create General Electric, but his financing was critical for its formation. He invested heavily in Thomas Edison’s various electric companies.

- The Merger: In 1892, Morgan facilitated the merger of the Edison General Electric Company and the Thomson-Houston Electric Company, forming the behemoth General Electric. This created a leader in the rapidly growing electrical industry.

U.S. Steel:

- Carnegie’s Steel Empire: J.P. Morgan’s most famous move was orchestrating the purchase of Andrew Carnegie’s massive steel empire, Carnegie Steel Company.

- Consolidation: Morgan combined Carnegie Steel with other major players, including Federal Steel Company and National Steel Company, to create the United States Steel Corporation in 1901.

- Billion-Dollar Giant: This move not only consolidated a significant portion of the American steel industry but also made U.S Steel the first corporation in the world to be valued at over a billion dollars.

J.P. Morgan’s Impact:

J.P. Morgan’s financial prowess and deal-making skills were instrumental in shaping the landscape of American industry during the Gilded Age. His influence brought stability to volatile markets, modernized corporations, and helped drive the rapid industrialization of the United States. However, he was criticized for creating monopolies and wielding too much financial power.

Let me know if you’d like to learn more about the Gilded Age, famous industrialists, or the history of any specific companies!

Morgan expanded his financial empire into banking, offering loans and investments for major corporations and governments.

Morgan’s overpowering role in the American economy was demonstrated in this political cartoon (Wiki Image).

You’re right! Here’s how J.P. Morgan’s expertise in banking fueled the growth of his financial empire:

- Beyond Railroads: While J.P. Morgan initially made his fortune by reorganizing and consolidating railroads, he quickly recognized the vast potential of banking to generate wealth and influence.

- Powerful Banking House: His firm, J.P. Morgan and Company, became one of the most powerful banking institutions in the world. It was renowned for raising massive amounts of capital quickly and discreetly.

- Loans to Corporations: Morgan’s bank underwrote bond offerings and provided enormous loans to major corporations. This gave him influence over these companies, further solidifying his position as a central figure in American capitalism.

- International Finance: J.P Morgan’s banking activities even extended to governments. He facilitated loans to foreign nations, helping to finance wars and infrastructure projects. This made his bank a significant player on the global financial stage.

- Stabilizing the Economy: While often criticized, Morgan’s banking prowess was seen as crucial during economic turmoil. During the Panic of 1907, he organized financial support and stabilized markets, preventing a catastrophic collapse.

Consequences of Morgan’s Banking Reach:

- Immense Influence: Morgan’s banking empire greatly influenced industries and the American economy. This level of power was met with both admiration and fear.

- Concerns of Monopoly: Critics accused Morgan of amassing too much power, stifling competition, and creating an unhealthy concentration of wealth and control within a single entity.

Let me know if you want to explore how J.P. Morgan’s actions shaped the American financial landscape!

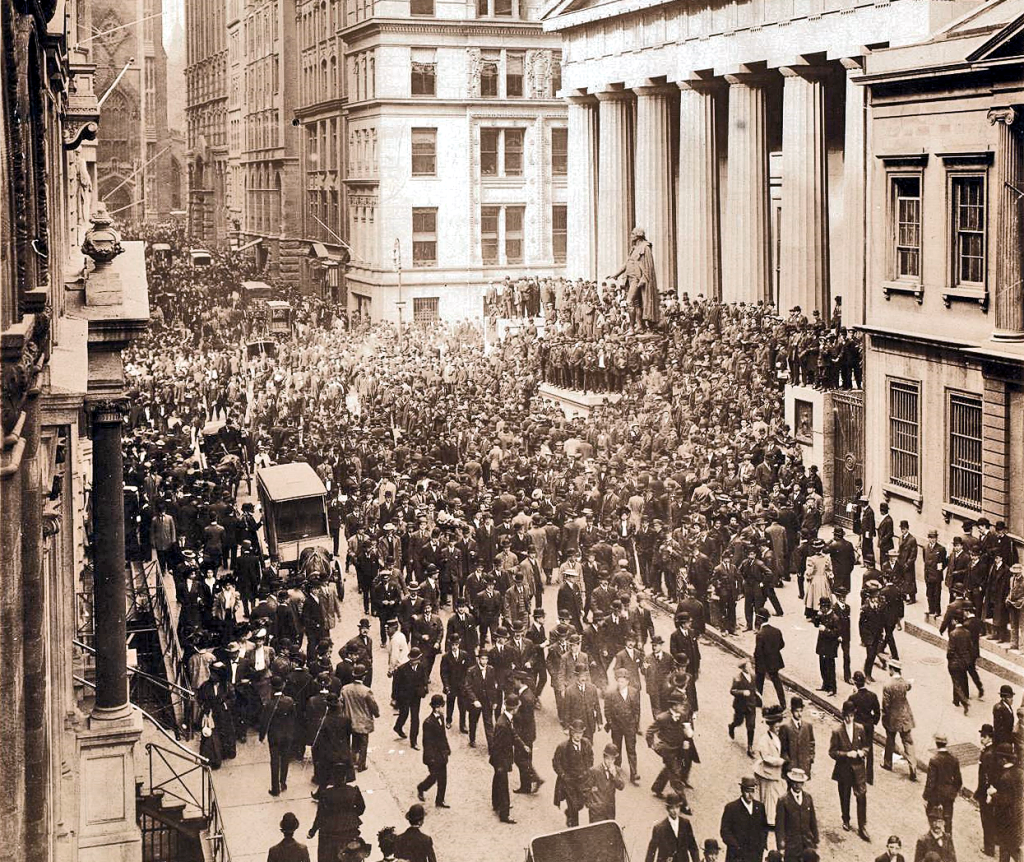

Morgan played a controversial role in stabilizing financial markets during the Panic of 1907, leveraging his immense power to organize bailouts and restore confidence.

Wall Street during the bank panic in October 1907. Federal Hall National Memorial, with its statue of George Washington, is seen on the right (Wiki Image).

You hit the nail on the head! Here’s a breakdown of J.P. Morgan’s controversial role in the Panic of 1907:

The Panic

- Chain Reaction: The Panic of 1907 was a severe financial crisis triggered by a failed attempt to corner the copper market. This led to the collapse of the Knickerbocker Trust Company, one of the largest trusts in New York City.

- Contagious Fear: Panic spread and people began withdrawing money from banks and trusts en masse. This created a liquidity crisis, threatening to collapse the entire financial system.

Morgan’s Intervention

- Reluctant Hero: Morgan initially hesitated to intervene, but as the crisis deepened, he recognized the potential for total economic disaster.

- Convening the Power Players, Morgan gathered powerful bankers and financiers at his mansion, where he essentially locked them in his library until they agreed on a rescue plan.

- Shoring Up Trust Companies: Morgan and his associates poured their personal wealth and considerable influence into shoring up struggling trust companies. He coordinated loans, provided funds, and encouraged rival cooperation to prevent further collapse.

- Restoring Confidence: Morgan’s actions, while self-serving, did succeed in stemming the panic. Public confidence began to return, and the worst of the crisis was averted.

The Controversy

- Too Much Power: To many people, Morgan’s intervention highlighted a dangerous concentration of financial power in the hands of one man. It raised concerns about the lack of government oversight and fueled fear of a financial oligarchy.

- Profiteering from Crisis: Critics accused Morgan and his associates of deliberately manipulating the markets or even engineering the crisis for financial gain.

- Necessity vs. Danger: The Panic of 1907 fueled a debate that continues today: Was Morgan’s intervention a necessary evil to save the economy or a demonstration of the dangers of unchecked financial power?

The Fallout

The Panic of 1907 and Morgan’s role in resolving it contributed to significant reforms in the U.S. financial system, which included:

- The Federal Reserve: The Federal Reserve System was created in 1913 to provide a central banking system, more rigorous oversight, and a lender of last resort to prevent future panics.

Let me know if you would like to dive deeper into the specific actions Morgan took during the crisis or the debate surrounding his intervention!

Morgan faced criticism for his immense control over the financial system, becoming a symbol of Wall Street’s power.

Absolutely! J.P. Morgan became a lightning rod for criticism, symbolizing both the vast potential of Wall Street and its dangers. Here’s why:

- Monopolization Fears:

- Railroad Kingpin: Morgan’s earlier consolidation ventures in the railroad industry fostered concerns that he was creating monopolies that stifled competition and could manipulate prices.

- The “Money Trust”: As his financial empire grew, so did scrutiny. Critics coined the term “Money Trust” to describe the perceived collusion between Morgan and a small network of powerful bankers. This fueled fears of them controlling whole industries and manipulating markets for their gain.

- Unprecedented Influence:

- Bailing Out the Government: J.P. Morgan held so much wealth and sway that he twice (in 1895 and 1907) rescued the U.S. Treasury by supplying much-needed gold or coordinating financial rescues. This highlighted the unsettling fact that a private citizen held more financial power than the government.

- Public Suspicion: The average American could scarcely comprehend Morgan’s vast wealth. This led to suspicion, accusations of profiteering, and even conspiracy theories about his motives and behind-the-scenes manipulations.

- Symbol of the Gilded Age Excess:

- Opulent Lifestyle: Morgan’s yachts, mansions, and extravagant art collection became symbols of the extreme wealth inequality characteristic of the Gilded Age.

- The Face of Wall Street: He was seen as the embodiment of the unchecked power and greed associated with Wall Street and the financial elite, especially by those struggling financially.

Consequences

- Populist & Progressive Era Pushback: Fears of Morgan and the “Money Trust” gave rise to Populist and Progressive movements that pushed for anti-trust legislation, financial regulations, and greater government control of the economy.